About

Put Unisyn to work, Invest your time where it’s needed

At Unisyn, we are pivoting the lending industry with innovative AI solutions that enhance efficiency and produce measurable results. Our platform enables lenders to streamline their operations, speed up loan approvals, and effectively manage risk. This allows you to concentrate on what truly matters: growing your business and serving your customers.

Lowering Risk and Cost of Money for Lenders, Lessors, and Brokers passing savings to borrowers --- this is new mission statement change everywhere

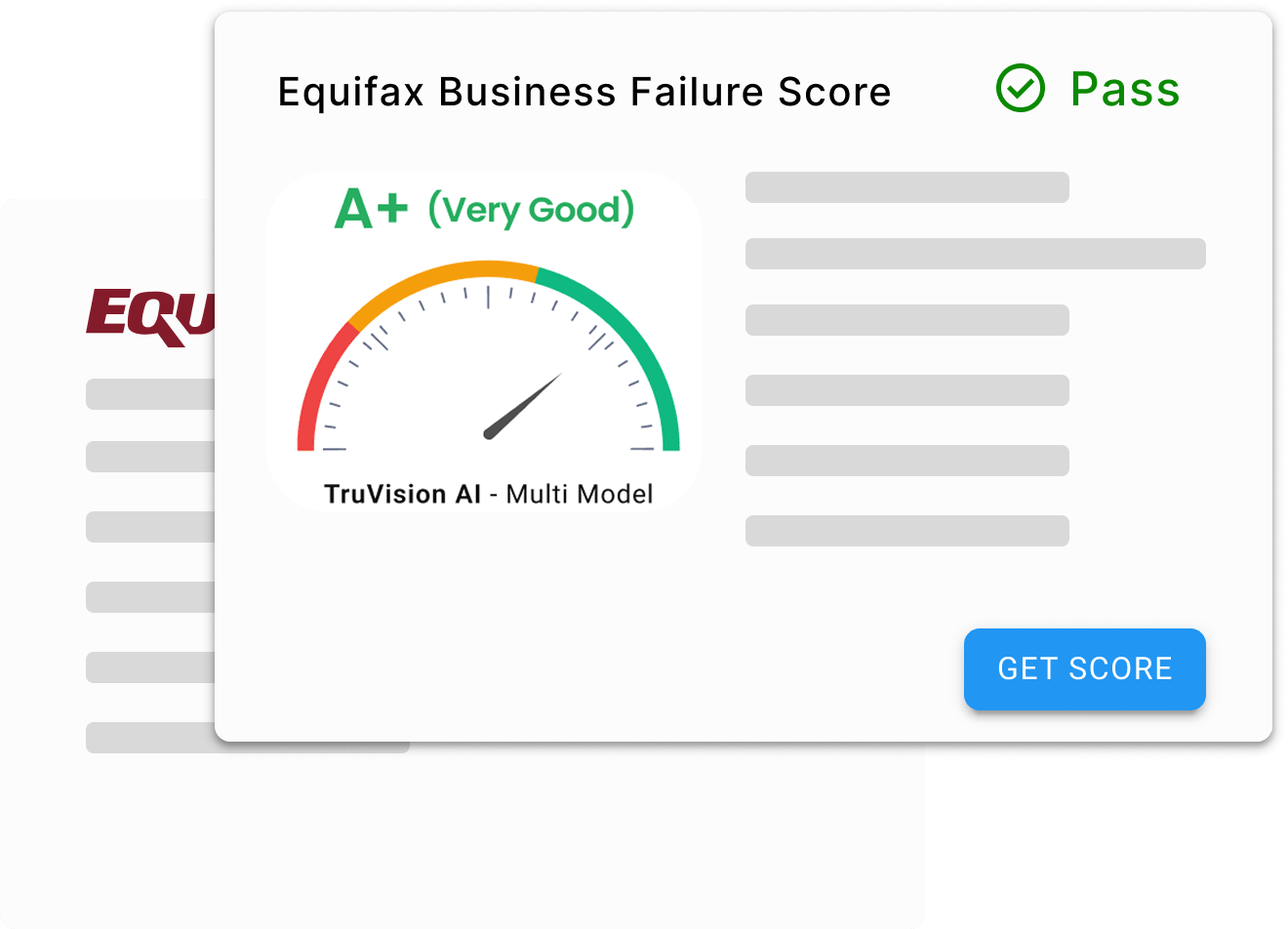

Whether it’s automating document verification or providing real-time risk analytics, we equip you with the tools to make smarter, data-driven decisions.

We Help Your Lending Operations Harness The Power of Unisyn

Our Mission

Our mission is to empower borrowers, brokers and lenders to achieve superior efficiency and profitability through a transformative, AI-powered platform. By automating routine tasks and offering real-time insights, we help you allocate resources where they matter most, enhancing loan funding processes, mitigating risk, and driving sustainable growth. Our dedicated team continuously innovates to ensure that every loan decision is backed by intelligence and precision.

Our Purpose

Smart Spending, Strategic Growth

With Unisyn's advanced loan management solutions, your resources are spent wisely. We help you streamline the entire loan management cycle, from application to final approval, reducing operational costs and ensuring compliance. Our platform not only enhances the speed and accuracy of your funding process but also positions your organization for long-term success in a competitive market.

Our Story

Pioneering the Future of Lending

Our journey began with a vision to transform traditional lending. Frustrated by the inefficiencies and risks of outdated systems, our founders set out to create a platform that leverages AI to deliver faster approvals, smarter risk management, and enhanced profitability. Today, Unisyn stands at the forefront of the digital lending revolution, driven by a commitment to innovation and excellence. Join us as we redefine the future of lending and create lasting value for our partners.