Features

Outcome-Driven Loan Management Cycle

Transform your brokerage and lending operations with a seamless, AI-powered lifecycle that accelerates funding, mitigates risks, and drives measurable business outcomes. Our system integrates real-time risk analytics, automated document verification, and centralized communication to optimize every stage, from initial application to final approval, ensuring faster decisions and enhanced portfolio performance.

Core Platform Capabilities

Intelligent Loan Management Gain Total Visibility & Control

Take full command of your lending operations with AI-powered automation, real-time tracking, and actionable insights—all in one unified platform.

Dynamic Kanban & List views for seamless loan tracking

AI-powered alerts for key deadlines & opportunities

Interactive dashboards with deep financial insights

One-click access to full deal history for transparency

SafeForms™ Builder

Intelligent, Compliant & Seamless Form Creation

Intelligent, Compliant & Seamless Form Creation Eliminate manual errors and reduce application delays with our AI-powered form automation and compliance screening.

Drag-and-drop form builder with smart field recommendations

Dynamic workflows & conditional logic for personalized experiences

Automated data validation & regulatory compliance screening

Secure document uploads with advanced OCR processing

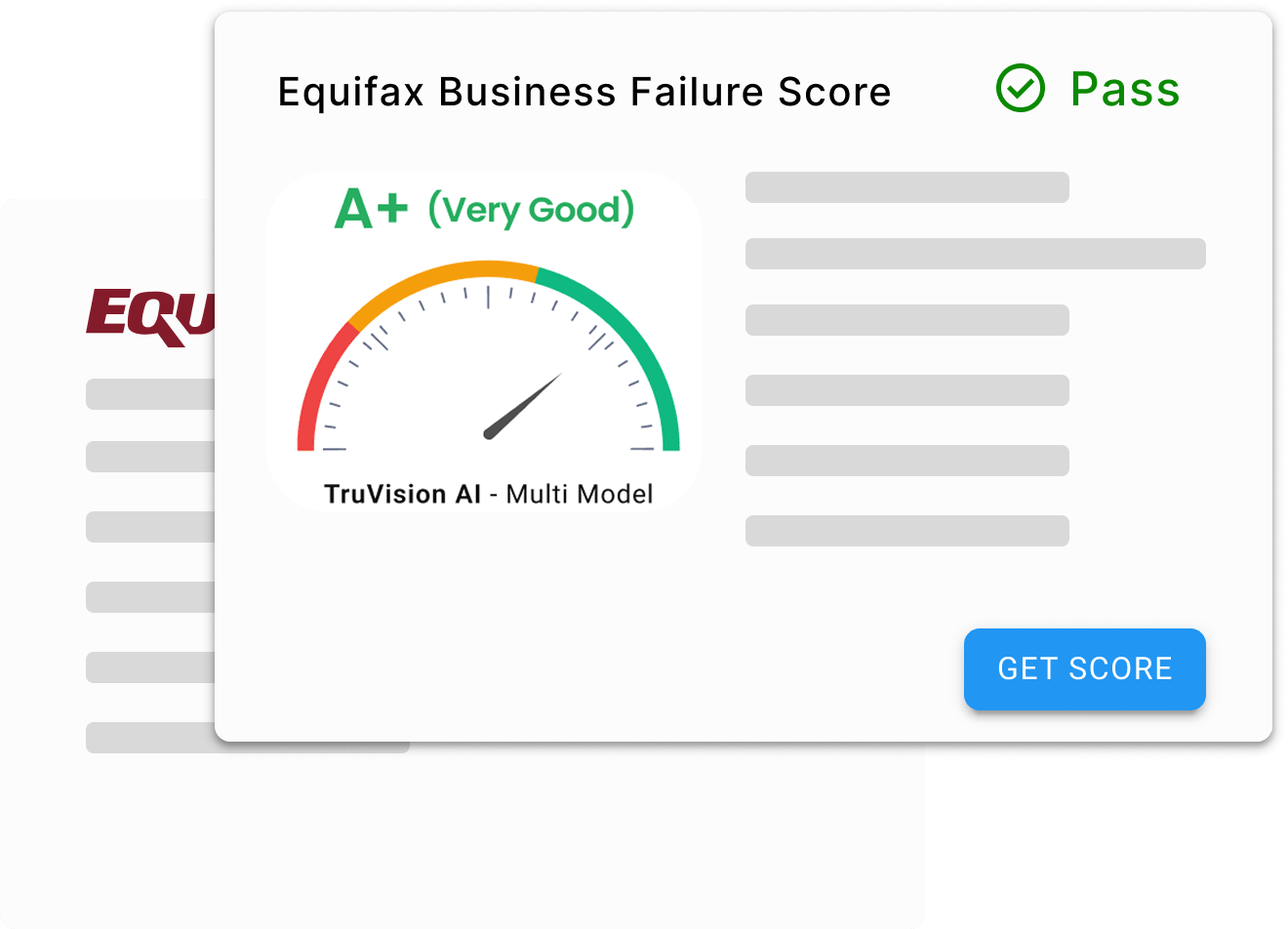

RiskVision AI™

Your Always-On AI Risk Analyst

Your Always-On AI Risk Analyst Make informed lending decisions with real-time risk assessments, trend detection, and compliance monitoring.

24/7 automated risk assessments with AI-driven precision

AI-powered anomaly detection for fraud prevention

Real-time underwriting & compliance monitoring

Customizable risk models for predictive default analysis

DocEasy™ AI Parser

Turn Documents into Actionable Data in Seconds

Turn Documents into Actionable Data in Seconds Extract and validate borrower information effortlessly with 96%+ accurate AI-driven document processing.

Automated document extraction for faster approvals

Smart error detection & validation to prevent inaccuracies

Custom parsing rules & batch processing for large datasets

Multi-language support for seamless global compliance

ClearComm AI™

Automated, AI-Enhanced Client Communication

Automated, AI-Enhanced Client Communication Enhance borrower-lender interactions with AI-powered messaging, chatbots, and sentiment analysis.

AI chatbot for instant borrower support & document requests

Smart message routing & prioritization for quick responses

Multi-channel communication (Email, SMS, Voice) for better engagement

Sentiment analysis to proactively improve customer experiences

Master Data Hub

Your Single Source of Truth

Your Single Source of Truth Centralize your lending data and eliminate data silos with a powerful AI-enriched management system.

Advanced search & filtering for instant access to critical data

API-ready integrations to sync with third-party platforms

Custom reporting & real-time insights for smarter decisions

Intelligent CRM

Redefining Relationship Management

Transform lead management and borrower engagement with AI-driven insights, automation, and seamless CRM integrations.

360° contact & deal tracking for full borrower visibility

AI-driven lead scoring & opportunity insights for high-value clients

Automated workflows to accelerate conversions

Seamless integrations with major CRM platforms

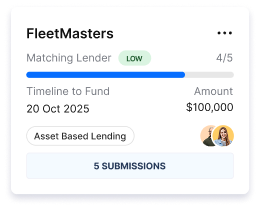

SmartMatch™ AI

The AI-Powered Deal Matcher

The AI-Powered Deal Matcher Connect borrowers with the right lenders and best loan offers in real time.

Instant lender-borrower matchmaking to optimize approvals

AI-driven success rate predictions for smarter lending decisions

Competitive offer analysis with real-time rate insights

Customizable deal criteria for precise loan matching

API Marketplace

Plug & Play Integrations for Limitless Expansion

Plug & Play Integrations for Limitless Expansion Seamlessly integrate Unisyn with leading financial, banking, and credit platforms to expand your capabilities.

One-click API integrations with trusted financial services

Real-time status tracking & usage analytics for transparency

Secure, compliant data exchange for risk-free transactions

Automated monitoring to ensure integration health