How We Transform Lending

Power Smarter Lending Decisions with AI-Driven Automation

Every day, lending teams lose valuable time to manual document reviews, risk assessments, and compliance checks. At Unisyn, we eliminate the bottlenecks with intelligent automation that accelerates approvals, reduces risk, and enhances operational efficiency—allowing your team to focus on strategic growth.

How We Transform Lending

Merge Audiences

Unify borrower insights with AI-powered data aggregation.

Save Time

Automate tedious processes to streamline workflows.

Smart Budget Allocations

Optimize financial strategies with real-time data-driven decisions.

360° Loan Lifecycle Management for Every Stakeholder

360° Loan Lifecycle Management for Every Stakeholder From instant document verification to real-time portfolio monitoring, our platform empowers lenders to approve more qualified borrowers with confidence—while keeping risk in check.

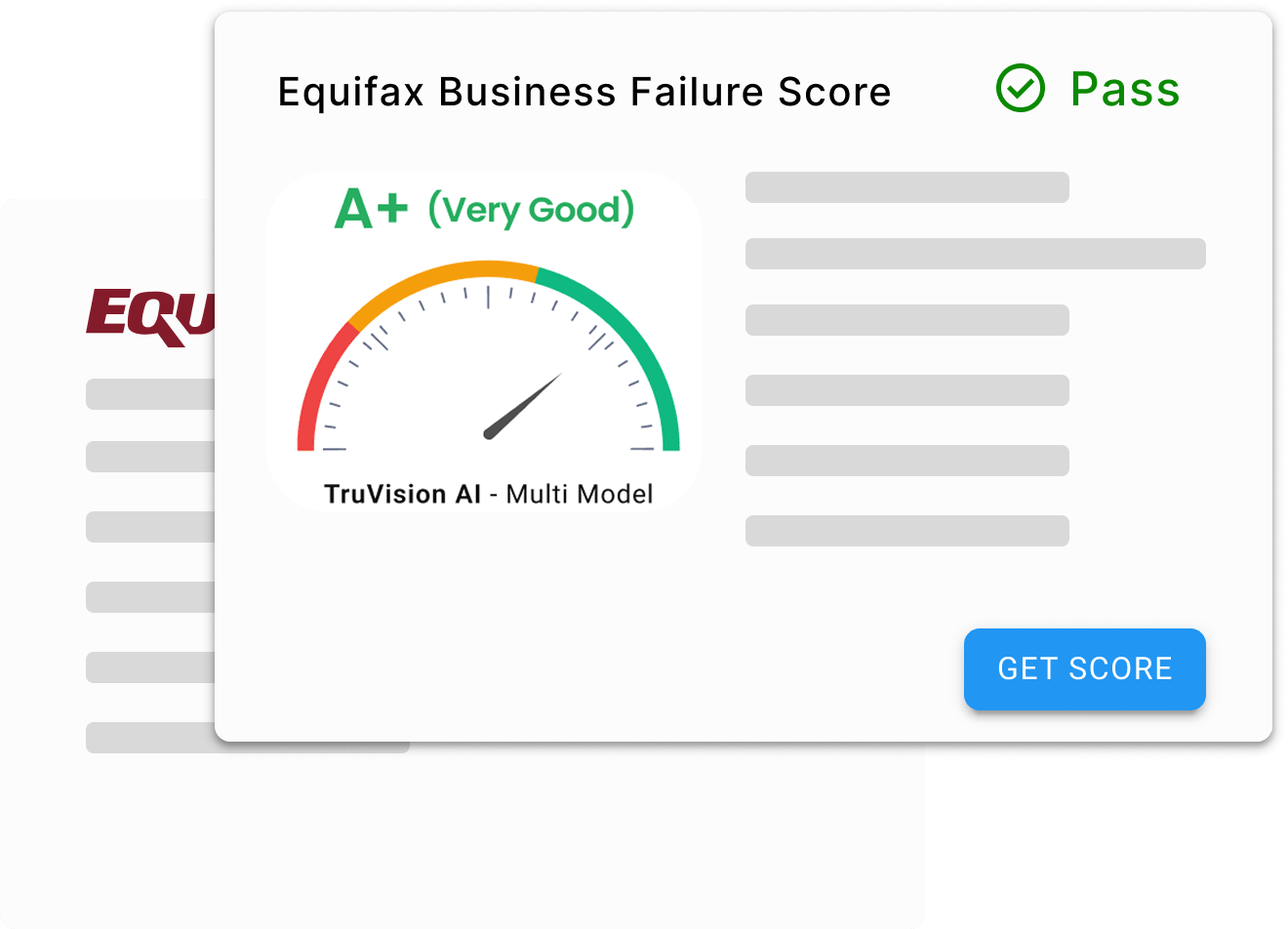

Enhance accuracy. Reduce errors with AI-driven compliance and fraud detection.

Make data-backed decisions. Leverage predictive analytics for smarter lending strategies.

Effortlessly scale, boost efficiency, and cut manual workload. Unisyn is the future of lending—make faster, smarter, safer decisions today.