For Direct Lenders & Lessors

Accelerate Approvals & Minimize Risk with AI-Driven Precision

Lenders & Lessors

Unisyn equips direct lenders and lessors with powerful AI-driven

solutions designed to streamline loan origination, enhance risk assessment, and automate compliance—allowing you to fund more qualified borrowers faster while mitigating risk.

Book a DemoFaster Loan Approvals

Automate application reviews, document verification, and borrower risk assessments for quicker funding decisions.

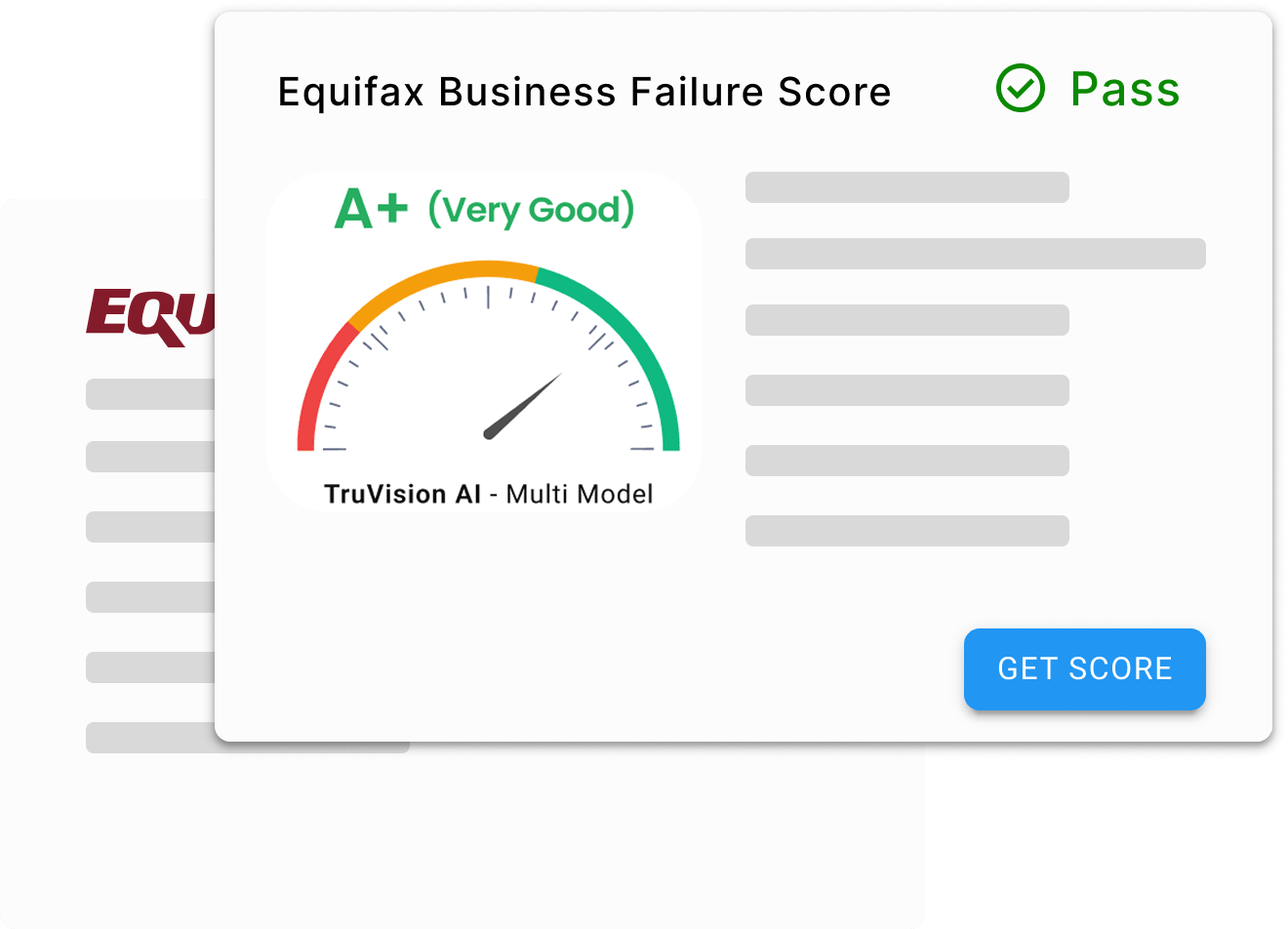

RiskVision AI™

Advanced predictive analytics to evaluate borrower risk in real time, helping you approve with confidence.

Smart Portfolio Management

Monitor loan performance, identify early risk indicators, and optimize funding strategies.

AI-Powered Compliance & Audit Readiness

Automate regulatory checks and ensure full compliance with ever-changing financial laws.

Seamless Document Processing

Extract, validate, and organize loan documentation instantly with DocEasy™ AI Parser.

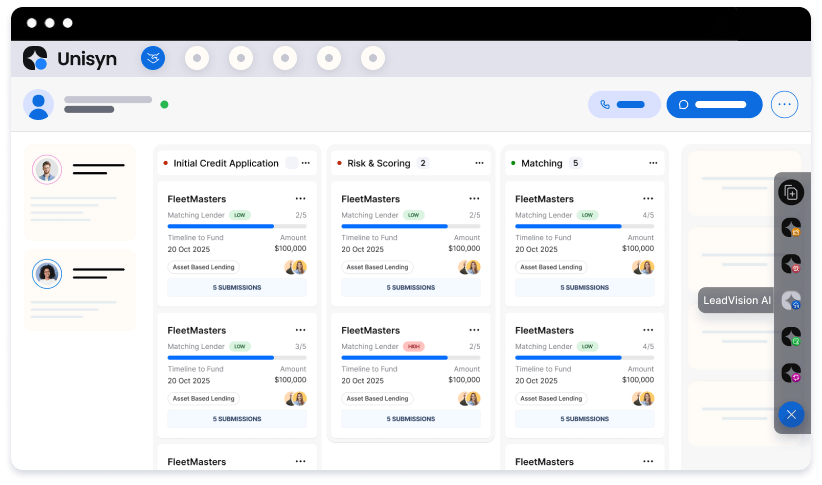

Centralized Loan Dashboard

Gain full visibility into loan portfolios, client interactions, and underwriting decisions in one AI-powered platform.

Automated Fraud Detection

Prevent fraudulent applications with AI-driven anomaly detection and identity verification tools.

Seamless API Integrations

Connect Unisyn with core banking systems, credit bureaus, and financial platforms for real-time data syncing.

Optimized Lease & Loan Structuring

AI-driven recommendations help you structure competitive leasing terms while maximizing profitability.

From Risk Map integrations to powerful analytics - Unisyn serves you better

Transform your lending operations by funding more loans, reducing processing times, and enhancing your risk management, all with an AI-powered solution that delivers clear, measurable outcomes.